Special accounts are those GL accounts that are compulsory to the Micronet General Ledger. Micronet selects these GL accounts and displays them as defaults at various areas within the Ledger. Special accounts also relate to Profit GL accounts and specify where in the Balance Sheet profit should appear.

Refer to "Selecting a Company to Edit".

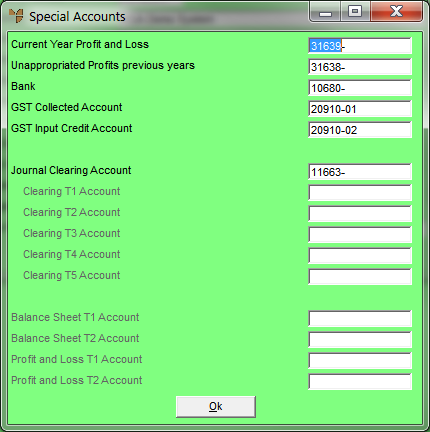

Micronet displays the Special Accounts screen.

|

|

Field |

Value |

|

|

Current Year Profit and Loss |

Enter the GL account that reflects the current period or current year net profit within the Balance Sheet of a business entity. This is not the GL account for Net Profit found in the Profit & Loss report. Micronet calculates net profit within the ledger for each GL period and reports this amount to the GL account Net Profit. It also transfers this amount to Current Year Profit and Loss in the Balance Sheet. This ensures that the Balance Sheet for the period reports a true and fair value for the business, thereby including any profit made during the period. This amount is calculated exclusively by Micronet and posted automatically to the GL account. |

|

|

|

Technical Tip It is very common for users to accidentally post transactions to this account when they are updating their Balance Sheets at the end of a financial year. Many receive a final adjusting journal from their external accountant and enter it to their General Ledger. If the final entry is for the Balance Sheet only and you have not been asked to adjust your Profit & Loss items, then the journal includes an adjustment to profit in the Balance Sheet. Do not post this adjustment to Current Year Profit and Loss; you will unbalance your ledger! That is, the Trial Balance Report reflects an out of balance in Debits and Credits. The amounts appearing in Current Year Profit and Loss GL account are exclusively posted by Micronet. To ensure that transactions are not entered to this GL account, set up the Account Type as a Non Posting account (refer to "File - GL Accounts - GL Account"). In the case of the adjusting journal above, the adjustment to profit should be entered against Retained Earnings or Unappropriated Profits Previous Years. |

|

|

Unappropriated Profits previous years |

Enter the GL account that reflects profits from previous years within the Balance Sheet of a business entity. This is commonly referred to as Retained Earnings. At the end of a financial year, amounts accumulating in the Current Year Profit and Loss are automatically transferred to Retained Earnings. This clears out Current Year Profit and Loss for the new financial year. |

|

|

Bank |

Enter the GL account that reflects the most frequently used Bank account within the business. Micronet displays this Bank account as the default when users are entering payments and receipts to the General Ledger. It also defaults to this GL account first in the Bank Reconciliation program. This GL account should have an Account Type of Bank (refer to "File - GL Accounts - GL Account") |

|

|

GST Collected Account |

Enter the GL account for GST Collected. This account is displayed as the default GST account when users are posting receipt transactions in the General Ledger. |

|

|

GST Input Tax Account |

Enter the GL account for GST Paid. This account is displayed as the default GST account when users are posting payment transactions in the General Ledger. |

|

Journal Clearing Account |

Enter the GL account that reflects the Journal Clearing account for the Micronet Distribution System. This account captures transaction adjustments made to customer (debtor) accounts that do not affect the bank account. These amounts transfer from MDS via integration. The Journal Clearing Account also has an important secondary function. It captures any imbalances that occur within the integrated amounts being transferred from the sub-ledgers and automatically posts a balancing entry to the Journal Clearing Account. These transactions are posted as Journal Clearing - External Ledger. This field directs Micronet to post an amount for integration balancing to this GL account. |

|

|

Clearing T1, T2, T3, T4, T5 Account |

|

|

|

Balance Sheet T1 Account |

If you are using T accounts for coding transactions, enter or select the T1 account that should default each time a user selects a Balance Sheet GL account during transaction entry. Users can override this default if required. |

|

|

Balance Sheet T2 Account |

If you are using T accounts for coding transactions, enter or select the T2 account that should default each time a user selects a Balance Sheet GL account during transaction entry. Users can override this default if required. |

|

|

Profit and Loss T1 Account |

If you are using T accounts for coding transactions, enter or select the T1 account that should default each time a user selects a Profit & Loss GL account during transaction entry. Users can override this default if required. |

|

|

Profit and Loss T2 Account |

If you are using T accounts for coding transactions, enter or select the T2 account that should default each time a user selects a Profit & Loss GL account during transaction entry. Users can override this default if required. |

|

|

|

Reference The T accounts fields are only enabled if Enable T Accounts is set to Yes on the MGL General Configuration screen (refer to "Edit - General Ledger Config - General Ledger Setup"). |

Micronet redisplays the Change Existing Company screen.